Weekly Outlook

Weekly Market Overview: Key Technical and Fundamental Trends

Three consecutive weeks of gains in the USD have sent the USD index to the highest in two months at 103.20. While the market has been already priced in weaker rates in Q4/2024, the sustainability of the bullish performance in global equities (US, EZ & Japan) needs more than cheaper liquidity even if the SPX, Dow Jones & DAX at record-highs.

There is an important question now, is ECB going to weaken the risk appetite in EZ equities? German DAX index gained by 2.8% in a week, trading at record high, France40 advanced by 0.47%, Italy40 index increased by 2.75% and Spain index ES35 rose by 1.57% in a week. It is correct that weaker rates may support the risk appetite, that’s why the interest rate cut by ECB on Thursday was already priced in, and markets will re-shift the attention to more macroeconomics & ECB forward guidance that matter, not to forget that dovish stance by ECB is likely to trigger further gains in EZ stock indexes.

In the meantime, China’s government launched its own bazooka to bolster the stock market & enhance the confidence in its economy, such a confidence is crucial for the foreign direct investments – FDI that fell by -31% in August 2024. Chinese equity indexes rallied in the last month, but Chinese stocks deepened its losses in the last week by more than 9% in CSI300, -8.1% in Shanghai index, and -6.8% in Shanghai 50 as well after the weak data of inflation & trade disappointed the investors & raised questions about the growth outlook in the World’s second biggest economy. Meanwhile, the Yuan fell by more than -0.8% in a week, trading at 7.1287 vs USD, the weakest in a month, but we don’t think that the pressure on Yuan is over yet. Keep an eye on China’s GDP numbers for Q3/2024, will be released on Friday.

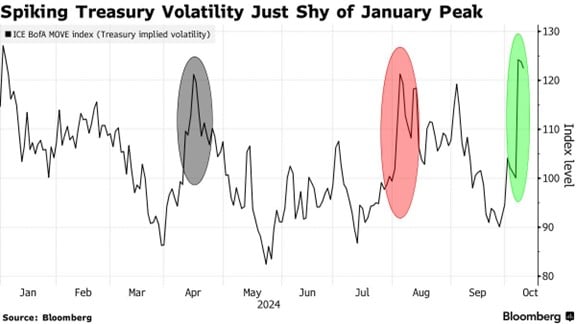

The yields on US10- Y bonds slightly increased by 0.06% in a week & traded at 4.08% on Monday, the highest level since late July 2024. The gain in the yields was the reaction to the good job market numbers in September, in other words the Fed may cut the rates less aggressively than the previous estimates. While cutting the rates by 0.25% in November is highly expected by 87% of the market’s participants, US treasury market volatility increased in the last few weeks as Bloomberg chart shows.